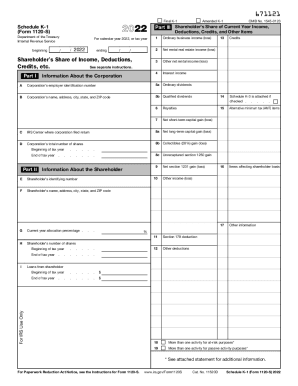

Who needs IRS Form 1120S Schedule K-1?

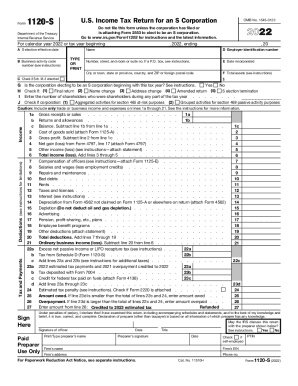

While all S-Corporations report their income on Form 1120S, the shareholders’ net income and loss from the corporation is reported in Schedule K-1. This document is prepared for each partner to be later attached to their individual tax returns.

What is IRS 1120S Schedule K-1 for?

Form 1120S Schedule K-1 is designed not only to outline the income earned or lost from a corporation but also for other earnings and deductions as well as a shareholder’s annual stock history.

Is IRS 1120S Schedule K-1 accompanied by other forms?

Initially, Schedule K-1 is a part of Form 1120S. However, it is sent separately to every shareholder to file their individual tax return Form 1040.

When is IRS 1120S Schedule K-1 Due?

As a part of Form 1120S, Schedule K-1 has the same due date as the form itself. It should be sent to the shareholder by March 15th or by September 15th if the extended deadline is allowed.

How do I fill out IRS 1120S Schedule K-1?

Schedule K-1 is a one-page document where an S-Corporation has to provide the following information:

- Name, address and identification number

- The shareholder’s personal and contact information

- The percentage of stock the shareholder owned during the current tax year

Once the two parts of the schedule are completed, the company has to track deductions, credits and other financial data a shareholder had within the current tax year.

Where do I send IRS Form 1120S Schedule K-1?

Once completed, Schedule K-1 must be sent to each Shareholder. When the shareholder gets the schedule, they use the information from it to file their personal income tax returns.

The video below adds more clarity to the process.