IRS 1120S - Schedule K-1 2024-2025 free printable template

Show details

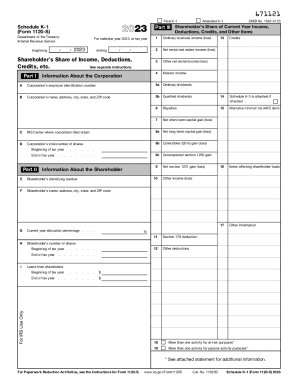

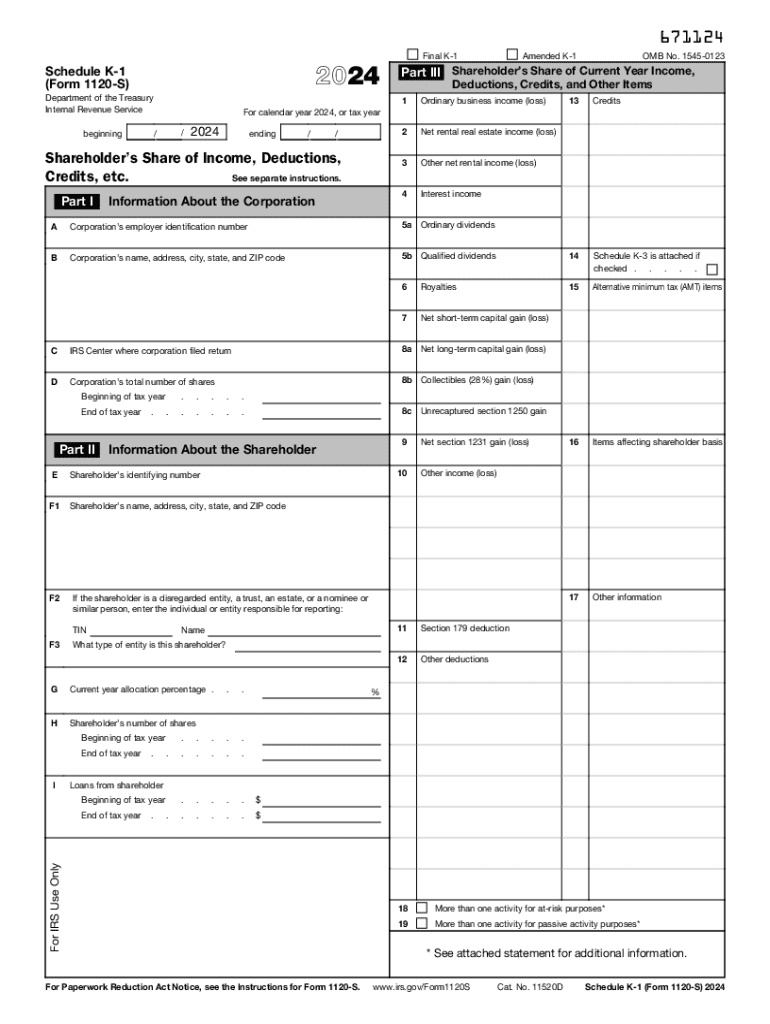

6711242024 Schedule K1 (Form 1120S) Department of the Treasury Internal Revenue Service /2024ending//Shareholders Share of Income, Deductions, Credits, etc. See separate instructions. Part IOMB No.

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS 1120S - Schedule K-1 Effectively

Effective Steps for Editing IRS 1120S - Schedule K-1

Guidelines for Completing IRS 1120S - Schedule K-1

Understanding and Utilizing IRS 1120S - Schedule K-1 Effectively

IRS 1120S - Schedule K-1 serves as an integral reporting tool for S corporations. It details each shareholder's share of the corporation’s income, deductions, credits, and losses for tax purposes. Understanding how to use and fill out this form is crucial for compliance and maximizing potential tax benefits.

Effective Steps for Editing IRS 1120S - Schedule K-1

01

Gather all necessary information about the S corporation, including financial records and prior K-1s.

02

Review the corporation's income, losses, and deductions for the tax year.

03

Fill in the basic identifying information on the K-1, including the corporation’s name, address, and Employer Identification Number (EIN).

04

Enter the individual shareholder's details, ensuring accuracy in Social Security numbers and ownership percentages.

05

Report the correct amounts of income, deductions, and credits applicable to each shareholder.

06

Double-check all entries for errors, ensuring compliance with IRS instructions.

07

Distribute the completed K-1 forms to each shareholder for inclusion in their personal tax returns.

Guidelines for Completing IRS 1120S - Schedule K-1

Filling out IRS 1120S - Schedule K-1 requires precise attention to detail. Start by identifying the correct tax year for the filing. Key areas to focus on include:

01

Part I: Basic information about the S corporation and the shareholder.

02

Part II: Shareholder's ownership percentage and stock information.

03

Part III: Income, deductions, and credits allocated to the shareholder. This includes ordinary business income, rental income, dividends, and capital gains.

Make sure to refer to the accompanying IRS instructions for specific line definitions and reporting requirements.

Show more

Show less

Recent Developments in IRS 1120S - Schedule K-1 Requirements

Recent Developments in IRS 1120S - Schedule K-1 Requirements

Recent changes in the IRS regulations regarding Schedule K-1 have simplified some reporting requirements while introducing new accountability measures. For instance, the recent tax reforms have increased the thresholds for items like the Qualified Business Income deduction, impacting the data reported on K-1.

Essential Insights on IRS 1120S - Schedule K-1

What is IRS 1120S - Schedule K-1?

Purpose of IRS 1120S - Schedule K-1

Who Is Required to Complete This Form?

When Do Exemptions Apply?

What Components Make Up IRS 1120S - Schedule K-1?

Submission Deadlines for IRS 1120S - Schedule K-1

Comparison with Other Tax Forms

Transactions Covered by This Form

Number of Copies Required for Submission

Penalties for Failing to Submit IRS 1120S - Schedule K-1

Required Information for Filing IRS 1120S - Schedule K-1

Other Forms Typically Filed with IRS 1120S - Schedule K-1

Submission Address for IRS 1120S - Schedule K-1

Essential Insights on IRS 1120S - Schedule K-1

What is IRS 1120S - Schedule K-1?

IRS 1120S - Schedule K-1 is a tax form used by S corporations to report the income, deductions, and credits that each shareholder is entitled to. This form aids shareholders in accurately reporting their earnings on individual tax returns, thus ensuring correct tax liability assessment.

Purpose of IRS 1120S - Schedule K-1

The principal aim of the K-1 is to substantiate the pass-through taxation feature of S corporations. Unlike C corporations, S corporations pass income directly to shareholders, which is then reported on individual tax returns. This structure prevents double taxation.

Who Is Required to Complete This Form?

IRS 1120S - Schedule K-1 must be completed by S corporations that have shareholders. This includes any qualified corporation that has elected S corporation status under IRS rules. Each shareholder will receive their own K-1 report detailing their individual share of the corporation's income and losses.

When Do Exemptions Apply?

Exemptions from the need to file or complete Schedule K-1 occur in certain situations, such as:

01

Corporations with no income during the tax year.

02

Shareholders below a specific income threshold, which is defined by the IRS guidelines.

03

Transfer of shares where no distributions or income have been realized.

What Components Make Up IRS 1120S - Schedule K-1?

The form is composed of three key parts:

01

Part I: Contains the corporation's identification and business information.

02

Part II: Details the shareholder's information and ownership structure.

03

Part III: Provides specific income and loss disclosures applicable to the shareholder.

Submission Deadlines for IRS 1120S - Schedule K-1

The K-1 must be filed by the S corporation with the Form 1120S by the 15th day of the third month following the end of its tax year, typically March 15 for calendar year filers. Shareholders should receive their K-1 by this date to ensure accurate income reporting on their tax returns.

Comparison with Other Tax Forms

Schedule K-1 differs from other tax forms like Form 1065 (used by partnerships) and IRS Form 1040 (individual tax return), primarily due to its focus on S corporations. While Form 1065 also reports pass-through income, it is directed towards partnership structures, which have different filing requirements and options.

Transactions Covered by This Form

IRS 1120S - Schedule K-1 generally covers various transactions related to the S corporation's operations, including:

01

Ordinary business income and losses

02

Rental income or losses

03

Dividend income

04

Capital gains and losses

Number of Copies Required for Submission

Typically, three copies of Schedule K-1 are needed: one for the IRS, one for the corporation’s records, and one for each shareholder. Shareholders will require their copy for personal tax filings.

Penalties for Failing to Submit IRS 1120S - Schedule K-1

Failing to submit Schedule K-1 can lead to various penalties, which may vary based on the severity of the oversight:

01

Minor Errors: Potential fines starting from $50 for errors or omissions.

02

Serious Noncompliance: Penalties can escalate to $250 or more if the form is not filed timely or properly.

03

Fraudulent Filings: If found intentionally misleading, corporations may face more severe legal ramifications as well as substantial financial penalties.

Required Information for Filing IRS 1120S - Schedule K-1

To ensure accurate completion, the following information is needed:

01

Corporate name and EIN

02

Shareholder's full name and Social Security number

03

Shareholder’s ownership percentage

04

Income and loss amounts attributable to the shareholder

Other Forms Typically Filed with IRS 1120S - Schedule K-1

Alongside Schedule K-1, S corporations also file Form 1120S as their primary tax return, which summarizes the corporation's income, deductions, and more. Additional forms may include Form 4562 for depreciation or Form 8825 for rental properties.

Submission Address for IRS 1120S - Schedule K-1

Completed forms should be sent to the appropriate IRS service center based on the corporation’s geographic location. Refer to IRS Publication 4163 for detailed mailing addresses to ensure proper submission.

In summary, IRS 1120S - Schedule K-1 is vital for accurately reporting and understanding income from S corporations. Ensure all steps are followed meticulously to avoid penalties, and stay informed about any updates or changes to maximize the benefits of this tax reporting tool. If you require assistance or wish to start using a fluid template for your tax preparations, consider reaching out to our support for dedicated help.

Show more

Show less

Try Risk Free