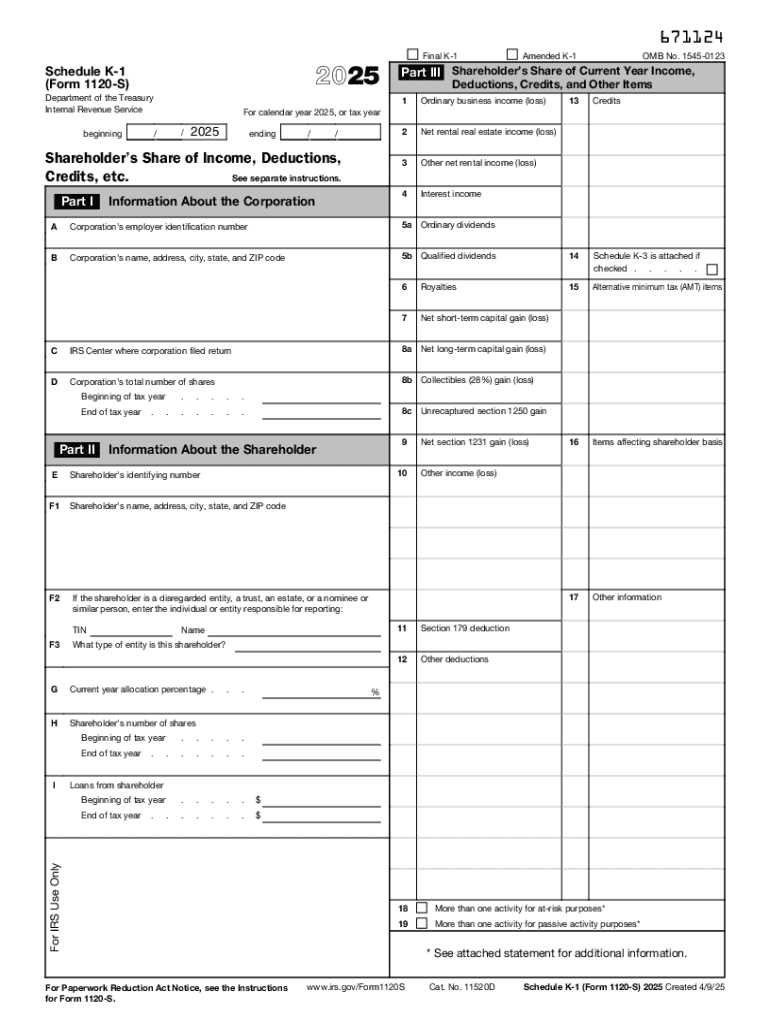

IRS 1120S - Schedule K-1 2025-2026 free printable template

Instructions and Help about IRS 1120S - Schedule K-1

How to edit IRS 1120S - Schedule K-1

How to fill out IRS 1120S - Schedule K-1

Latest updates to IRS 1120S - Schedule K-1

All You Need to Know About IRS 1120S - Schedule K-1

What is IRS 1120S - Schedule K-1?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1120S - Schedule K-1

What should I do if I realize there's an error on my IRS 1120S - Schedule K-1 after submitting it?

If you discover an error on your IRS 1120S - Schedule K-1 post-filing, you must file an amended return using Form 1120S and include the correct information on a new Schedule K-1. It's advisable to explain the corrections clearly and retain copies of any correspondence or documents related to the amendment for your records.

How can I verify that my IRS 1120S - Schedule K-1 was received and is being processed?

You can verify the receipt and processing status of your IRS 1120S - Schedule K-1 by checking the IRS online portal or by calling the IRS directly. Keep in mind that e-filed submissions generally have faster processing times, and it may be beneficial to track any confirmation numbers provided during submission.

What are some common mistakes to avoid when preparing IRS 1120S - Schedule K-1?

Common mistakes include misreporting income, failing to provide TINs for all partners or shareholders, and incorrect allocation of deductions. To minimize these errors, ensure all data is cross-verified against operating agreements and financial statements while double-checking for accuracy in multiple entries.

How does an e-signature work for the IRS 1120S - Schedule K-1?

E-signatures are generally acceptable for IRS 1120S - Schedule K-1 as long as both the signing process and the provider are compliant with IRS guidelines. It is important to ensure that the process you use maintains the integrity and security of signatures, as well as meets any applicable legal requirements.

What should I do if I receive an IRS notice regarding my Schedule K-1?

If you receive a notice from the IRS concerning your Schedule K-1, first read the notice carefully to understand the issue at hand. Gather relevant documents to address the notice's concerns, and respond within the timeframe specified. If you're uncertain about how to proceed, consulting a tax professional can be beneficial.

See what our users say